iTHINK Financial offers financing for new and used golf carts, whether you want to go for a joy ride, hit the golf course or make errands more fun!

- Low Rates*

- Flexible terms

- Affordable payments

- Quick approvals

Learn more about our loan options today.

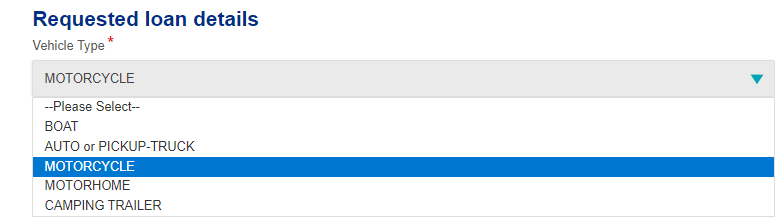

*All golf cart makes are listed under "Vehicle Type" MOTORCYCLE in the application.

* APR = Annual Percentage Rate. Rates based on terms, credit score, and other conditions. Inquire within for details. Not all members will qualify for the lowest loan rate. Rates subject to change without notice. All iTHINK Financial Loans are subject to income and identification verification. Contact a Member Service Advisor for the most current rates, terms, fees and conditions that may apply. Terms reflected on the Loan Rate sheet are maximum terms allowed. The Credit Union may require shorter repayment terms for certain loan amounts.

iTHINK Financial offers vehicles loans for new and used:

- Cars/SUVs/Trucks

- Motorcycles

- Boats

- Camping Trailers

- Motorhomes

- Golf Carts

Please Note: iTHINK Financial does not lend outside of the continental United States.

Features

- Competitive rates

- Pre-approval available, based on credit history

- No application fees

- A variety of terms to fit your budget

Featured Vehicle Loan Rates

-

New Auto Loans

as low as

5.49% %

APR* -

Used Auto Loans

as low as

5.49% %

APR* -

Motorcycles

as low as

6.49% %

APR* -

Motorhomes

as low as

6.49% %

APR* -

Boats

as low as

6.49% %

APR* -

Camping Trailers

as low as

6.49% %

APR* -

New Golf Carts

as low as

6.49% %

APR* -

Used Golf Carts

as low as

6.49% %

APR*

We make it easy to apply!

The fastest way to get a loan is to Apply Online. Or you can call us at 800.873.5100 during normal business hours, email loans@ithinkfi.org, or stop by your nearest branch to apply in person. Need help? Make an appointment.

Convenient Loan Repayment Options

- Use QuickPay to pay your Credit Union loan using a credit card, your iTHINK Financial account, or an external account. Schedule one-time or recurring payments from your computer or phone 24/7.

- Transfer your payment from your account at another financial institution using eTransfers or contact us to set up a recurrent Direct Payment.

- Set up recurring scheduled automatic transfers from your Credit Union checking or savings account to your loan by using Online Banking.

- Make one-time transfers from your Credit Union checking or savings account to your loan by using Online Banking or our Mobile Banking App.

- Make payment by mail or at a branch or at a CO-OP Shared Branch.

Set up email or text alerts through eAlerts for convenient payment reminders.

Vehicle Title Information

Registration and Title (Lien Recording) Instructions

If purchased from a private seller: Once the original title, bill of sale and Vehicle Power of Attorney have been received by the title department at iTHINK Financial, all completed paperwork will be sent to the DMV. In the meantime, please anticipate correspondence via phone or email from our title department to determine which local DMV location you would like to use to register your collateral and receive your tag from. Please use the shipping tracking number to know when your paperwork will arrive at your local DMV. Once the delivery date is known, contact your local DMV to schedule your processing appointment.

If purchased from a dealer: Generally, the dealer will complete the registration and lien placement and, in most cases, the DMV will forward the title to iTHINK Financial. Should you receive the title after registration and lien placement, simply forward it to:

iTHINK Financial – Loan Ops

647 Roswell Street NE

Marietta, GA 30060

Please note: If a temporary tag is needed, please contact your local DMV/Tag agency to obtain one.

LIEN

A lien is the right to take and hold or sell property of a debtor as security or payment for a debt. iTHINK Financial requires Members who offer collateral to secure a loan, such as a car loan or personal expense loan, to record iTHINK Financial as the first lien holder on that collateral. This means that if the Member defaults on the loan, iTHINK Financial can take the collateral and sell it to pay off the loan.

VIN REQUIREMENT

When applying for a collateral loan, Members must supply the vehicle identification number (VIN) when using an automobile or motorcycle as collateral on a loan, or a hull number or serial number when using a boat or other collateral. iTHINK Financial requires this number at the time of application, unless the loan is a pre-approval.

How to register your vehicle/obtain a license plate

You have signed all your documents, so what's next?

- All documents will be sent to iTHINK Financial's Title Department.

iTHINK Financial's Title Department will complete all paperwork to be sent to the DMV (title, application, etc.). - A specialist from the Title Department will contact you via text, email or telephone for the address of the DMV/Tag agency that is most convenient for you to complete the title process.

- The documents will be sent via UPS to the DMV/Tag agency of your choice. A text or email will be sent to you with the tracking information.

- Once documents are delivered to the DMV/Tag agency, you can go in to pay any taxes and fees that are required.

- In the meantime, please contact your local DMV/Tag agency for a temporary tag (if applicable).

Please note: This process can take up to 30 days.

Thank you for choosing iTHINK Financial for your auto loan financing!

Check your Loan Application Status

Want to check the status of your loan application, securely upload loan-related documents, or communicate with your Loan Officer?

Fully Protected Loan

Fully Protected Loan Options:

- Mechanical Breakdown Protection – Lower than dealer offers on mechanical breakdown coverage!

- GAP Total Loss Protection – Competitive rates on insurance to cover the GAP!

- Payment Protection – Protect yourself, just in case!

Other Resources

- Auto Buying Guide – Visit our page for helpful information about the vehicle buying and loan process.

- Auto Buying Service – Save time, save money, and eliminate the dealer hassles, pressure, and confusion.

- Submit your proof of insurance online: To submit proof of insurance for your auto, recreational vehicle, or mortgage loan, please email your documentation to insurance@myinsurance.com.

- If you received a notice regarding (loan) collateral insurance, provide proof of coverage by clicking here: myinsuranceinfo.com

- Auto Insurance – Coverage options to meet your individual needs!

- Calculators – Use our financial calculators to find the best car loan for you!

- Consumer Loan Disclosure

Member Testimonials

Read what our members have to say about getting an Auto Loan at iTHINK Financial.